Four beds good, five beds bad.

THE GUIDE

Jayne Dowle

Unable to sell your home? Some families do not want five or more bedrooms

People swoon when you tell them that you’re selling a five-bedroom house. How lovely, they say. Think of the space for children, the potential for guests. However, Britain’s “ideal home” for buyers now has just 3.5 bedrooms, according to the property website Zoopla. With the market in some areas almost static, sellers are forced to face a counterintuitive fact: abundant bedrooms can be a curse.

Would a four-bedroom-plus-study property sell better than a five-bedroom family home? Yes, says Anne-Marie Desborough, of Dexters estate agency in Richmond upon Thames. “I would say that the optimum number of bedrooms is three or four. Your average Richmond family has two children, so five or six bedrooms seems a little wasteful.”

Hugh Blake, an associate partner at Carter Jonas in Cambridge, says affordability is a determining factor nationwide. “All too often, the vendors of five and six-bedroom homes are too ambitious in what they think their property is worth. In the current market overpricing is an immediate deterrent to buyers, who simply aren’t prepared to overstretch themselves.

Create a space suitable to let that can generate an income if advertised on Airbnb.

“When it comes to larger properties, the pounds per square foot value is largely determined by the first 2,500 sq ft. This is elevated by a good-sized main reception room, kitchen, and four generous bedrooms; the fifth and sixth bedrooms contribute to a fraction of a property’s overall value.”

There is also the question of perception. Are buyers really looking for a certain number of bedrooms — or rather a house of particular dimensions?

“Since all the houses now have floor plans, the gross internal floor area has become much more important to buyers than number of bedrooms,” says Giles Lawton, a partner at Strutt & Parker in Oxford. “In the old days buyers would say they wanted five bedrooms, but what they meant was they needed three rooms to sleep in and two studies, or a house of a certain size.”

So what can you do to present an “over-bedroomed” home in the best light?

Four, five or six?

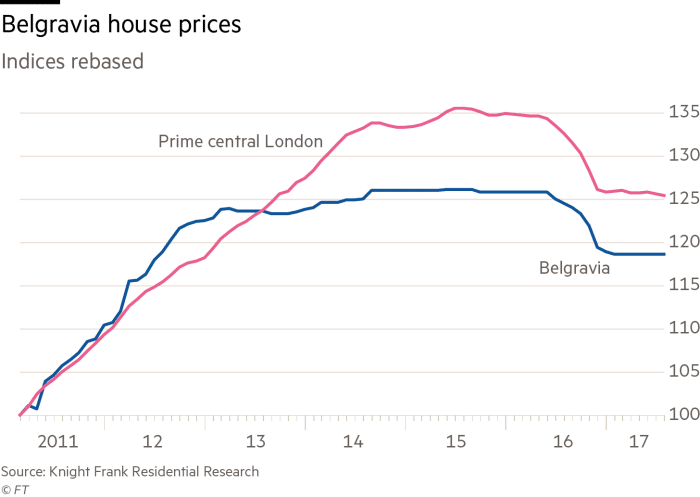

You must establish what is attractive to your target buyers. As Martin Bikhit, the managing director at the estate agency Kay & Co, points out, prime central London and grander parts of the home counties still attract buyers looking for a large number of bedrooms. Stock is low, so appeal is enhanced.

He says that fewer than 30 properties are for sale in W1 with five-plus bedrooms. “When one does become available it often gets snapped up quickly as wealthy individuals seek homes that can accommodate family members and staff.”

In rural areas too, such as Yorkshire, the Cotswolds and Cornwall, agents report that farmhouses and period properties with five or six bedrooms are perennial favourites with professional families and relocating buyers.

Cedar bedroom cupboard by Plain English, from £5,000

However, in popular “town” locations, four bedrooms is optimal, five at the most. “Buyers in Oxford tend to want just one extra bedroom that can be used as a guest room, rather than lots of extra rooms,” says William Kirkland, a partner at Knight Frank in the university city. “It’s a question of balance, however. They still want space to grow as they are likely to be borrowing, paying stamp duty land tax and therefore won’t want to move for a long time if they can help it.”

Too many bedrooms? Or not enough bathrooms?

It could be that rather than having too many bedrooms, you don’t have enough bathrooms. If there is only one “family bathroom” in a five-bedroom house, it makes sense to turn the smallest bedroom into an extra bathroom or en suite. For instance, a small middle bedroom can be transformed into a super-useful “Jack and Jill” bathroom with access from each adjoining sleeping area.

“Add an actual bath if possible,” says Rupert Carr, a director at the Kensington estate agency Milton Stone.

Other suggestions include a study, or two, as more people work from home. “A spare room might also convert to a media or entertainment room, or a light room can create an excellent art studio or workshop,” says James Way, a partner at Knight Frank in

Stratford-upon-Avon, Warwickshire

Victoria Harrison, the editor of the home renovation and design platform Houzz recommends creating a yoga studio or meditation space. A gym could be a good investment, but the heavy equipment makes this best-suited to a ground-floor bedroom.

Camilla Dell, the managing partner at Black Brick, a buying agency, likes the idea of incorporating a kitchenette into a top-floor bedroom to create a contained area for teenagers. Blake adds: “We would also recommend converting a boxy fifth bedroom into a walk-in wardrobe with lighting and shelving. This may be done for less than £1,000.”

The home-search expert Carol Peett, at West Wales Property Finders in Pembrokeshire, has the ultimate solution. “If your house has five-plus bedrooms that buyers are put off by, turn this around by creating a space suitable to let and sell it as somewhere that can generate an income from advertising on Airbnb.”

Keep overall balance in your home

Open-plan living has blown apart the old theories on the most desirable ratio of bedrooms to reception rooms. However, it’s important to ensure that the flow and space available for various functions convinces buyers. To achieve this Jamie Hope, the managing director at Maskells, suggests turning an extra bedroom with decent proportions into an elegant first-floor drawing room.

Or follow the new-build sector and consider creating a family room, as Neil Simpson, the sales and marketing director at Bewley Homes, suggests: “Homeowners [want] to utilise upstairs bedroom space as dedicated family or play rooms. This is so much the case that one of our house types in Witney, Oxfordshire, features a large first-floor room dressed as a family room, but it could just as easily be utilised as a master or twin bedroom.”

Bear in mind the arrangement of rooms. If you wish to keep a guest room, is it in the right place? “Ideally the master needs to be close to the children’s bedrooms, with number four as the guest/spare room,” says Alex Newall, the managing director at Barnes International.

Even smaller homes can suffer from bedroom issues, adds Blake. “If a three-bedroom house is sticking, it could be good to combine the second and third bedrooms into one super space.”

Must-haves to maximise appeal

Space and storage are key. “Beds have increased in size, so a master bedroom must now be large enough to accommodate a superking with ease,” says Peett. “Another reason why it can be better to knock two bedrooms into one.”

Add large wardrobes, bring in a dressing table and, if an en suite is not feasible, include a vintage washstand with sink and cupboard space instead.

Indulge at your peril

For the total wow factor it could be tempting to transform a superfluous bedroom into an open-plan master suite, with freestanding bath and lavatory.

This may be the epitome of glamour in a boutique hotel room, but it will add nothing to your home’s resale value, warns James Robinson, of the London mews specialist agency Lurot Brand. “Unless your bedroom is palatial avoid the bath in bedroom idea — and trust me when I say the only time an open-plan WC is acceptable is in a prison cell.”