3rd January 2025

11mins

Black Brick celebrates its 18th birthday this month, and we predict that our coming of age will coincide with a year of fights over family houses, savvy international buyers seeking big ticket bargains, and an increasingly challenging landscape for buyers trying to navigate London’s highly nuanced and increasingly convoluted property market.

The big question: how will house prices perform?

The past year has been hard on London’s most expensive boroughs thanks to a combination of global and national uncertainties, high buying costs, and a general air of caution.

As a result, prices have fallen across Prime Central London (PCL). According to the latest UK house price index, the Government’s official house price monitor, Kensington and Chelsea has seen average sale prices drop 20.3 per cent to just under £1.12m, Westminster is down 4.4 per cent, and Hammersmith and Fulham’s average prices are down 10.5 per cent year on year.

These official Government figures do come with a significant time lag and most commentators agree that the market picked up a little post-Budget. But the leading price forecasters cannot agree on what will happen next.

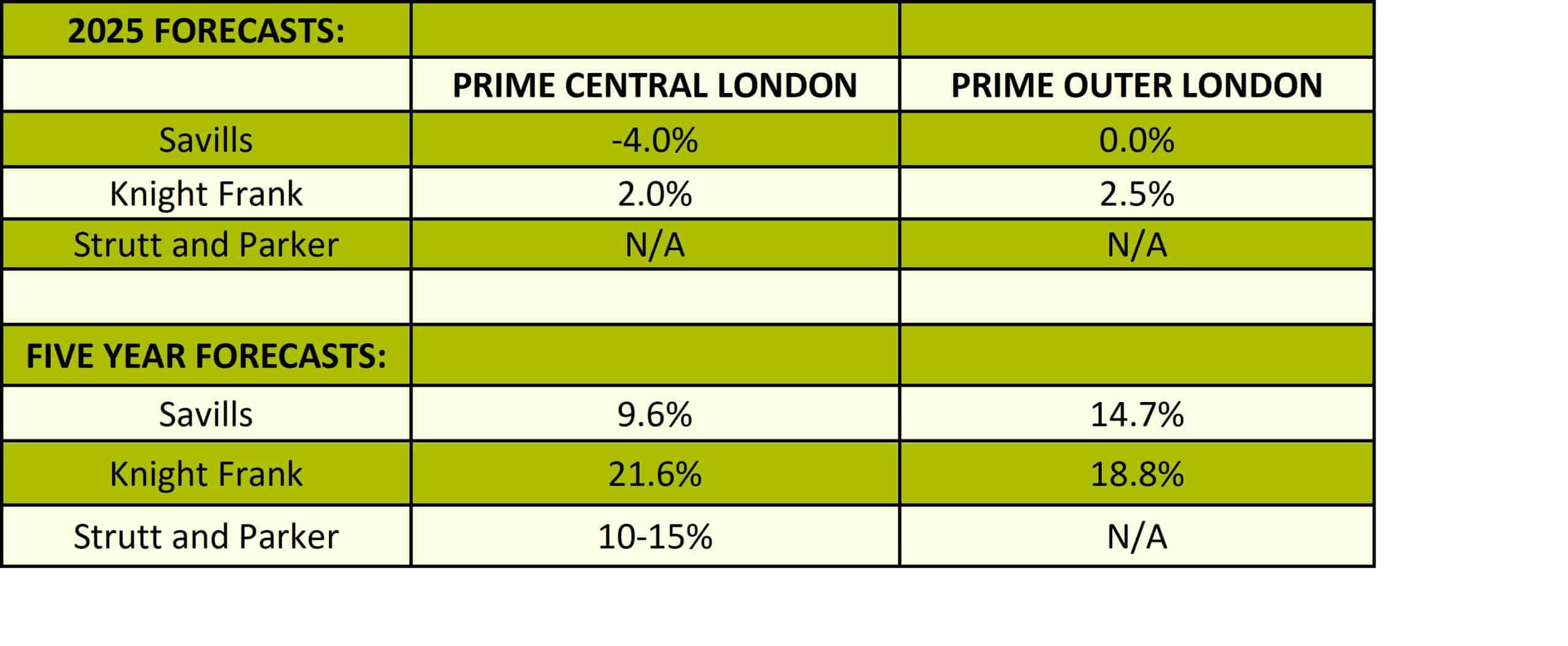

Estate agent Knight Frank is forecasting annual price growth of two per cent in PCL this year, and 2.5 per cent in Prime Outer London (POL).

Lucian Cook at Savills is significantly more pessimistic. He predicts that PCL prices will fall four per cent during 2025 while prices in POL will flatline.

Over five years Strutt & Parker thinks PCL prices will grow by a modest ten to 15 per cent. Savills thinks prices will grow by an even more modest 9.6 per cent. Knight Frank is the most bullish of the bunch, suggesting prices will grow by 21.6 per cent.

“I have never seen such a huge variation between the main forecasts,” said Camilla Dell, Black Brick’s managing partner. “Usually, the main estate agency forecasts are less than a point apart, but this time the differences are huge. My reading is that none of the agents really know where the market is headed next year and beyond.”

Prime outer London’s five-year forecasts are for growth of 14.7 per cent (Savills) or 18.8 per cent (Knight Frank).

Black Brick suspects that Savills’ more conservative view of the potential for price growth will be closest to the mark, because buyers are still extremely price sensitive. “Sellers are having to be very realistic and willing to sell at really big discounts in order to achieve a sale in the current market,” said Dell.

Forecasts, of course, can only give a snapshot of how the overall market is shaping up. The reality will be a far more complicated and nuanced picture with certain property types in certain locations selling strongly and others continuing to dive. “Forecasts are not gospel, and London is a very complex market,” said Dell. “There will be different outcomes in different parts of the capital. We continue to see a lack of supply for best-in-class family homes with gardens and parking in the most desirable streets of prime London, around Notting Hill for example, where bargain hunters may be disappointed.”

Welcome to the year of the family home.

Strong demand plus a shortage of supply of good quality period houses in affluent suburbs with good schools, green space, and easy commuter links made this sector easily the most competitive of last year, and Black Brick predicts that this trend will get even stronger in 2025.

“Last year we saw huge competition in the family house market up to £2m – the classic four bedroom Victorian terrace in the prime London suburbs, places like West Hampstead and Fulham,” said Dell. “I think that this part of the market will do far better than PCL in 2025.”

Tom Kain, partner at Black Brick, believes that this trend will be further fuelled by the introduction of VAT on school feels – proximity to good schools, both independent day schools and state schools, is becoming increasingly important to buyers.

Demand for family homes is also being stoked by first time buyers. High buying costs means many are skipping the traditional early steps on the ladder – a starter flat in central London, a slightly larger apartment when they couple up – and going straight in at the family home level to avoid funding multiple moves.

Elsewhere in London there are some postcodes which seem almost immune to the vagaries of the wider market. Houses on garden squares in Notting Hill, for example, are always hard to come by and often fought over by buyers.

On the flip side, global insecurity, the UK’s high buying taxes, plus the imminent dismantling of the Non Dom system, will all act as deterrents on overseas buyers looking for large, lateral trophy apartments to add to their global portfolios. “Second home apartments in places like South Kensington and Knightsbridge will be less in demand than they have been,” said Kain. “Prices could soften a bit on this sort of home.”

The last time the PCL market was on the back foot was after the Financial Crisis of 2007. Back then, it was international buyers who rode to its rescue. A London home was a must-have status symbol for buyers from across Eastern Europe, as well as the Middle East, USA, and China, and prices reached record highs as a result.

This time around, there is little sign that buyers from overseas will pull PCL out of the doldrums. International buyers are still out there but many are choosing the sunshine and low tax lifestyle of Dubai, rather than the UK where, from April, overseas buyers purchasing a second home for more than £1.5m will have to pay 19 per cent Stamp Duty.

One much-vaunted exception is American buyers. They started looking for overseas property as the US’s presidential campaign started to heat up and Donald Trump’s victory has encouraged more to consider a move. According to data from ADVSR.ai, some 22 per cent of US buyers were looking for property in the UK making it the most popular choice for North Americans. UK Sotheby’s International Realty, claims that four in ten $15m-plus property properties sold in the British capital in 2023 went to US buyers. At Black Brick, a record 25 per cent of our clients purchasing homes last year, were from the US.

London always has its share of buyers from Europe, the Middle East, and China, although those that are buying will only do so if they scent blood in the water.

“We have seen opportunistic overseas buyers come to the market who are looking for a deal, because they are obviously out there at the moment,” said Dell.

Dell is currently acting for an overseas buyer who is in the process of snapping up a six bedroom flat in Kensington which originally went on sale for an ambitious £30m. With no takers the owner dropped the price by increment down to a more reasonable £18m.

And Black Brick has just had an offer accepted at £14.55m, or £2,500 per square foot, less than half its original price and outstanding value considering the property’s quality and location.

“London will come back and now is a great time to buy prime assets,” said Dell. “We have been amazed by how much prime stock there is to choose from at the moment, and there are quite a few people who need to sell to the extent that they are willing to sell at a loss. Others have owned their properties a long time and so they are willing to be pragmatic about price.”

Kain points out that many of the vendors coming to the market have been waiting literally years for a good time to sell – from Brexit to the pandemic, through the outbreak of war in Europe and the Middle East, the cost of living crisis, and the 2024 General Election. “They have got to the point now where they can’t just sit it out any longer,” he said.

Dell suspects this buyers’ market scenario will continue throughout 2025, giving house hunters a solid window of opportunity before prices start to increase in 2026. “This is the moment when the really smart money is buying,” she said.

The Non-Dom tax system attracted some of the wealthiest men and women in the world to London. From April, it is being replaced by a new regime which will allow wealthy individuals to spend four years in the UK without being taxed on foreign income and gains.

The temporary nature of the new arrangement could encourage many new arrivals to opt for the flexible and comparatively trouble-free option of renting. And in a market where prices are flat and taxes are high, renting could simply make better financial sense for people who don’t plan to make London a long-term base.

Whatever the reason, prime rents are soaring. House price analyst, LonRes, reports that average rents in prime London are more than a third above their 2017-2019 (or pre-pandemic) average.

Black Brick, which noticed an 8% uptick in clients requesting rental searches last year, believes this trend will continue well into 2025. “The demand for high end rental properties could get quite competitive next year,” said Dell.

Despite cooling market conditions, one business which is definitely booming in London is estate agency.

According to GetAgent.co.uk, there are currently a record 7,325 firms serving the capital, an annual rise of 2.4%, with a proliferation of one-man bands and small boutique agencies setting up shop over the past few years.

This spike in numbers is making life harder than ever for buyers – who would have the time or the will to register with the estimated 235 agencies operating in Kensington & Chelsea alone?

To make matters even more complex, off market selling continues to grow. Kain estimates that 50 to 60 per cent of PCL properties are discreetly marketed without ever hitting the portals. And as AI evolves, so prop tech companies are proliferating. The number of property platforms giving professionals access to new instructions, most of which are off market, has mushroomed. Then there are the dozens of private WhatsApp groups set up by estate agents to offer selected contacts up to the minute information on homes as they hit the market.

Wading through all this information and talking to the right people is a skilled and an extremely time-consuming job requiring excellent contacts, a head for numbers, and a clear understanding of the nuances of London’s market. Which is why Black Brick believes that hiring a buying agent to assist you in your search will become more of a necessity than a luxury.

“The different channels you need to reach out to for a property search is vast,” said Dell. “It’s not enough to be on Rightmove or registered with a handful of estate agents. You will only be accessing at best 50% of the market through those dated channels.”

“It is vastly bigger than I could have imagined when I set up the business 18 years ago. The number of agents has exploded, there are so many sources of data, I am on perhaps 50 WhatsApp chats to keep up with off market sales. The market is now so fragmented that for unrepresented buyers, doing a property search without a buying agent is a massive risk. You simply won’t be seeing a huge proportion of the market.”

We would be delighted to hear from you to discuss your own property requirements. For a non-obligatory consultation, please contact us.